Young Muslims have to ‘pick between faith and education’ under current student loan system

Four in five Muslim students who DO take out the student loan feel they have compromised their faith

Asha was set to leave college, armed with three strong A-Levels and an ambition to go to medical school. But there was a problem. “I remember in 2013 speaking to my chemistry teacher and literally holding back the tears as I tried to explain to him why I couldn’t go to uni that year,” she tells me. Asha is one of many young Muslims who decided not to take out a student loan on account of their religious ideals.

In Islam, paying interest – or riba- is not permitted, leaving many Muslim students with just three uncomfortable options: go to uni despite having deeply-held religious beliefs, somehow find the money to self-fund £9,2500-a-year tuition fees as well as living costs, or don’t go to uni at all.

It’s no wonder that, according to the Muslim Census, 10,000 Muslim students opt out of uni or self-fund their tuition every year due to a lack of alternative student finance.

Way back in 2013, then Prime Minister David Cameron said: “Never again should a Muslim in Britain feel unable to go to university because they cannot get a student loan simply because of their religion.” He seemed to commit to making space within the student finance system to accommodate Muslim students, but since then, very little progress has been made.

With a review into the student finance system expected in the coming months, The Tab spoke to three Muslim students whose lives have been affected dramatically by the current student loan system.

‘University was never something I could really do. It made me feel hopeless’

Umayr

Umayr harboured dreams of going to Oxford and was encouraged by teachers at his state sixth form in Whitechapel to apply for an Arabic course at the uni. He certainly had the grades to back up this ambition, but while his peers were revelling in the success of getting offers from Russell Group universities, the reality set in that university wasn’t an option for him.

Umayr didn’t want to take out a student loan and certainly couldn’t stump up the cash to self-fund his tuition. “I made the decision early on that university was never something I could do,” Umayr tells me.“I didn’t know what I had in store for the following year. It made me feel hopeless, left out and frustrated.

“If you can’t use the student loan for religious reasons, you simply can’t go to university. That was something that was tough for me at the time.”

‘I literally felt like I was having to chose between getting an education and my religion’

Hana was also successful academically and like Umayr, was never going to take out a student loan. That’s why she dropped out of college. Hana didn’t see the point. “When I started [at college], within the first 12 months they started talking about university and UCAS.

“I was doing psychology business and applied science. As soon as they started talking about uni, I started looking into it and I realised there was no way I was going to be able to afford it. The loan just wasn’t an option,” she says.

Hana’s parents weren’t to0 fussed, as long as she kept busy, but the pressure from other members of her family was intense. From their perspective, Hana was squandering her education unnecessarily, when instead she should forsake her religious principles and take out the loan. “There was a lot of backlash from other people. They just didn’t understand. I literally felt like I was having to choose between getting an education and my religion,” Hana says.

Four in five muslim students who DO take out the student loan feel they have compromised their faith

The Muslim Census found that four in five of muslim students who do take out the student loan feel they have compromised their faith. One of Hana’s friends took a loan out to do a PGCE qualification. “She’s regretting it a lot. It’s affected her mental health,” Hana tells me.

Hana didn’t immediately abandon the idea of university. She started doing an apprenticeship at a nursery, supplementing her income with 15 hours of work at Primark on weekends. Hana had a dream of going to uni and was committed to saving the money until it was possible. Reflecting on this period of her life, she says: “I think it was very childish of me to think I could save over £27k in such a short amount of time.”

Hana began a Diploma Level four and five in education, the equivalent to two years at university. Now, she’s been able to get onto her third year and is working alongside her education to fund it.

Umayr also looked at alternatives to university education, eventually earning a degree apprenticeship in software engineering with BT. The apprenticeship is sponsored and involves Umayr working alongside his studies. “I’ve found it really enjoyable working in the technology industry for a big company like BT,” he tells me. “I was one of the fortunate ones.”

‘I went through a really difficult period of time’

Asha

While Hana and Umayr sought different paths, Asha refused to let go of her dream to go to medical school. Encouraged by David Cameron’s commitment to changing the tuition fee system, Asha got into Exeter University in 2014, deferring her place for two years.

When she began medical school, there was still no alternative student finance, so Asha started working night shifts as a carer (36 hours a week) on top of her full-time medical degree. Luckily, a couple months into her first year, she won a £5k scholarship. But she still had to work on the side to fund her studies. “It was really tough, but I thought to myself, if I just get through this year then next year the government will have made it available,” Asha tells me.

The uncertainty continued into her second year, but fortunately a further £8k of her fees were waived. Again, this took the pressure off, but Asha knew it was a short term fix. She kept working and working, the stress and exhaustion inevitably taking its toll on her. Asha didn’t have time to go home and see her family and felt stuck in a cycle of staying up for days or being unable to get out of bed at all.

“I went through a really difficult period of time,” she said. “I avoided people in general. I didn’t hang out with people because I didn’t have the energy or the time. And I’d feel really guilty about that too.”

A review into student finance is due to be published later this month. Hana, Umayr and Asha are hopeful for change

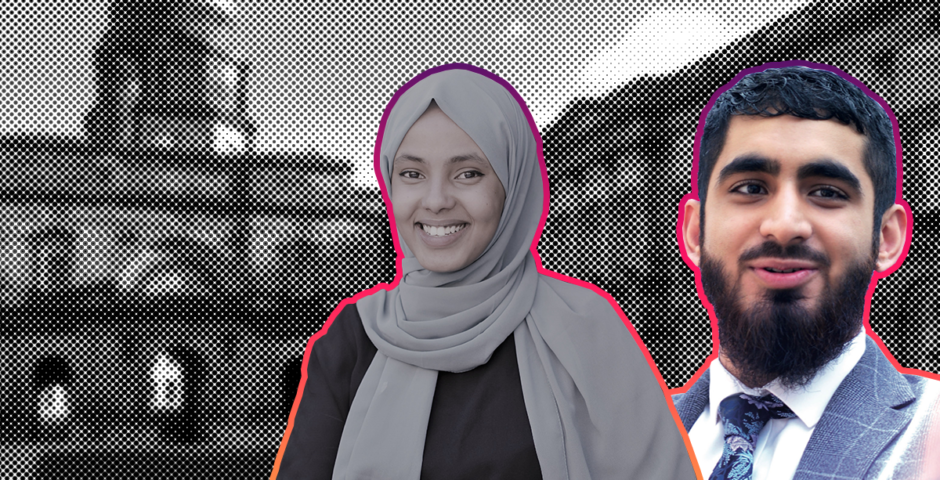

Asha with others campaigning for change

Asha used to believe that if you worked hard, you’re entitled to an education. She’s since changed her mind. “I realised it doesn’t matter how hard you work, you’re not entitled. You have to make peace with that and try and do as much as you can,” she says.

After her second year, she took some time out, obtained another scholarship for her fourth year, and is currently on another year off before her final year. But someone as hardworking as Asha never really takes time off. She’s spent her free time campaigning for changes to the student loan system and is starting to see some progress being made, eight years after David Cameron promised change.

Asha’s campaigning has now garnered support in parliament with MP Stephen Timms and Lord John Sharkey supporting her fight for change. They’re calling for alternative student finance for Muslim students to be provided as part of the government’s review into the student loan system, known as the Augur report. This is due to be published in November, but universities minister Michelle Donelan seems reluctant to pin down a date. Umayr, Hana and Asha all hope that whatever the outcome, future Muslim students won’t be forced to choose between their faith and their education.

Related stories recommended by this writer:

• ‘It was draining’: This is what Freshers’ Week is like according to autistic students

• Clubs are back – but so is drink spiking. Here are your stories

• ‘I was going down a dark route’: Young people on fighting gambling addiction