Here’s exactly how Durham students are coping with the cost of living crisis

A step-by-step guide for not blowing your entire student loan before Christmas

The last few years have seen dramatic increases in the cost of living. The prices of essentials like rent, food, and bills are skyrocketing and making living on a low income more difficult than ever before. Durham has hardly dodged this. While it might be somewhat cheaper than its southern peers, the university town has seen a housing crisis develop, as well as the expected price rises in all walks of life.

With these dangers in mind, it’s essential for students to save every penny they can. But in a university where conversations about Range Rovers and in-house cleaners regularly rear their heads in the Durfess pages, it isn’t easy to find useful financial information. Luckily, whether you’re a first year or a liver-out (or both), we’ve gathered a bunch of tips on all the ways you can cut your living costs in Durham and save as much as you can this year.

The housing situation

One of the most noticeable effects of the cost of living crisis is the rise in housing prices.

In the last year, there’s been an 8.2 per cent increase in monthly rent across Durham. When rent citywide is steadily climbing, it’s worth putting some real thought into your housing situation. As a group, decide whether to go for the cheaper houses further away from the city centre, or sacrifice a bit of cash to stay close to your lectures or the town centre.

While Gilesgate and Neville’s Cross may seem far away, if you’re looking to save on rent and don’t mind a longer walk or a short cycle, they can save some pennies in the long run. Another potential option is living in college. While accommodation prices may seem steeper than private housing, the inclusion of bills and potentially food could be worth it. But always check the numbers first, as these things vary dramatically on a case-by-case basis.

Take a look at your bills (if your bills aren’t already included)

Speaking of bills, a lot of students end up going for the easy and cheap bills packages advertised all over. These will essentially combine all your bills into a single neat payment. This removes the need to contact individual suppliers and deal with more complicated stages of installation in houses where bills aren’t included. While these can be good for avoiding lengthy phone calls and headaches with endless companies, once again it’s better to do the maths beforehand.

A lot of bills packages are actually substantially more expensive than paying for the cheapest decent option for each service individually. While this absolutely isn’t always the case, definitely check beforehand. You don’t want to end up paying for more than you need – or use.

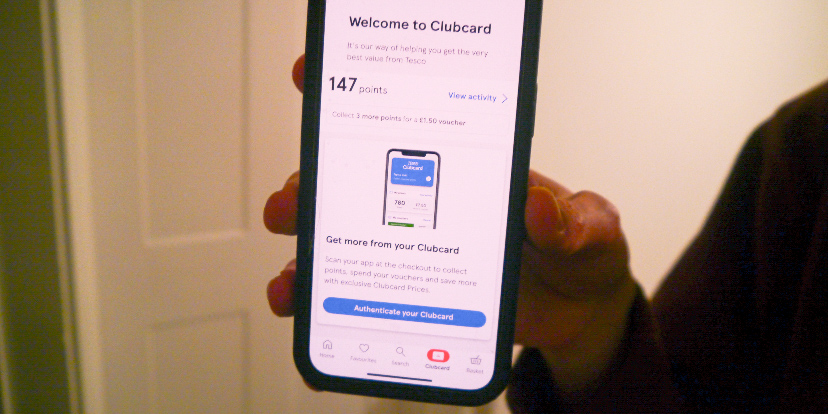

Shop like a student, and get a clubcard

Another area in which you can be more effective is in day-to-day expenses such as shopping. With food prices more unpredictable than ever, it’s worth making a consistent meal plan and budgeting accordingly.

A lot of Durham students go to Tesco by default due to the convenience of delivered shopping. But if you can manage the trek, other supermarkets further away from the centre of town are actually cheaper. Nonetheless, using your chosen supermarket’s clubcard (or equivalent) is a no-brainer for getting deals. It’s also worth checking if anywhere has student offers available. While these aren’t as common in supermarkets as in bars or online services, some will offer you discounts.

Get to know the student discounts

While on the topic of student discounts, it’s worth looking into these. They can cut costs that, while not directly connected to the cost of living crisis, will help lower your expenses. If you visit any city bars (i.e. not part of a college), but particularly the Library, you’ll want the Mixr app. It can give you a free student discount on almost every drink served there. It can also be pretty cost-effective to stick to college bars for bar crawls. Being run by students, these places know how difficult it can be to make ends meet, so drinks are usually cheaper.

Another good student discount app is UNiDAYS, which will get you big discounts while online shopping. Once again, helping cut costs at a time when, to paraphrase a certain blue supermarket, all small things make a difference.

Extra places to get support

When it comes to sources of information, obviously The Durham Tab is second to none. But if you want to know some more specific tips, several colleges and societies offer help on financial planning. Have a look at international societies and the 93 per cent club (it offers resources to help the state-schooled proportion of the university, who aren’t as underrepresented in Durham as you might think).

And overall, it’s just as important to prioritise making the most of your time at university. So if you take one thing away from this, it’s that you don’t have to go on fewer nights out or starve just to save money for heating. Just plan, and make sure you know the price of things. That way you can stay secure without wasting the prime time of your life.