‘I’m unnecessarily responsible with money’: A 22-year-old’s weekly spend on £26K

Murphy breaks down a week in the wallet whilst living at home and saving for a house

Location: Stirling – salary: £26,000 – lives with parents

Ever wondered what a week in the life of a responsible but social 22-year-old looks like, financially?

This week, our Money Talks look into the spending habits of Murphy, a marketing and operations executive based in Stirling.

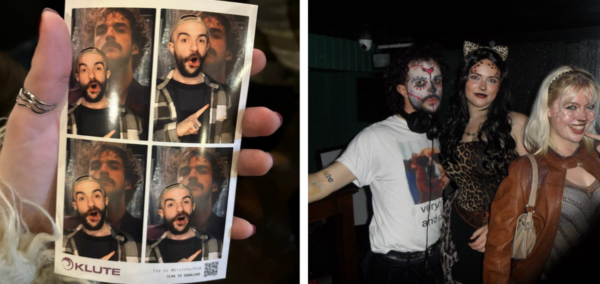

Meet Murphy, who calls herself “unnecessarily responsible” but still manages to eat out with friends, top up on petrol, and pay for subscriptions. They live with their parents, earn £26k a year, and dreams of owning their own first home, all whilst balancing student loans and car expenses.

Murphy describes themself as “unnecessarily responsible” with money. Their week is mostly essentials, the occasional social plan, and the creeping awareness that maybe contributing more to retirement should happen… at some point.

The week at a glance

Annual salary: £26,000

Living situation: With parents

Current commitments: Student loans and car expenses

Main money goal: Saving for a house

General attitude toward money: “Unnecessarily responsible” (mood)

Typical daily spend: About £15

Murphy’s spending diary

Monday

£40 – petrol

The week kicks off with a classic unavoidable expense: FUelling the car. Not glamorous, not fun, but absolutely essential for work and life in Stirling.

Daily total: £40

Tuesday

£0 – a no spend day

Nothing bought today. Not planned, just how the day went.

Daily total: £0

Wednesday

£26 – dinner with friends

Midweek socialising. A planned social event needed to fill the cup.

Daily total: £26

Thursday

£9.99 – subscription

One of those little monthly payments that you forget exists until it quietly reappears.

Daily total: £9.99

Friday

£15 – food shop

A top up for the essentials.

Daily total: £15

Weekly reflection

Total weekly spend: Roughly in line with the usual £15 a day average.

Nothing major or unexpected cropped up this week – no emergencies, no big treats, nothing dramatically over budget. Murphy describes the week as “fairly typical,” and honestly, it shows: A mix of essential costs and social spending.

They didn’t feel they overspent, didn’t have any surprise expenses and didn’t regret anything they bought. The only thing they want to improve is contributing more towards retirement – something we all consider but feels like tomorrow’s problem.

Conclusions

Murphy’s week is what happens when someone is trying to keep spending sensible while still maintaining a life. Between saving for a house, managing car costs, and chipping away at student loans, their approach is methodical but not miserable. All whilst still managing to balance essentials with treats.

They spend when it matters, mostly on friends and essentials, and hold back where they can. Responsible – maybe even unnecessarily so, in their own words.

Want to get involved?

Fill out the form below, with the option for all entries to remain strictly anonymous or with a pseudonym if you prefer.

From students to professionals, we want to see how real young people earn, spend, and save – so please answer as honestly as you can.

The log will take about 10 minutes to complete. Figures may be lightly edited for clarity and style.