Here’s why nearly 6,000 students regretted becoming involved in financial fraud last year

Money Muling: It’s not what you think

University is expensive. Even if you don’t include the nine grand a year you’re paying for tuition, the cost of housing, food and bus travel can add up to the thousands, and that’s without the added costs of socialising and printer credits.

Yes, a maintenance loan can help pay for these, but it’s not always enough. To cover the rest most students get a job, start a side hustle or, in the riskiest of cases, fall for some kind of “get rich quick” scheme. The problem is, these schemes are illegal. Last year thousands of students became involved with a specific type of financial fraud – Money Muling.

So, since students are one of the most at-risk groups, why not take some time to make sure you and your bank account remain safe:

Money Muling is a type of financial fraud. As a student, there are two common ways you can get mixed up in this illegal activity:

1) Your bank account could be used, without your knowledge, to receive and pass on stolen money

2) You could be recruited by a fraudster to use your bank account to transfer stolen funds in return for a monetary payoff

Gangs involved in criminal activities, such as terrorism, are known to use money mules to filter money abroad. By allowing someone to pass money through your account, you will become implicated in the crime too and be charged accordingly.

Cifas, a fraud prevention organisation, reported that in 2018 the number of money mules in the UK rose to 40,139 – nearly half of which were under 25. Cifas also reported that there was a 26 per cent rise in the number of under 21-year-olds acting as Money Mules.

For a lot of students, uni is the first time they’re living away from home and managing their own finances. This lack of experience led to nearly 6,000 students becoming Money Mules in 2018. Fraudsters target students because of their cash-strapped status, but that’s not an excuse. Whether you know the ins and outs of what’s going on or not, as soon as you let this happen, you become part of the crime.

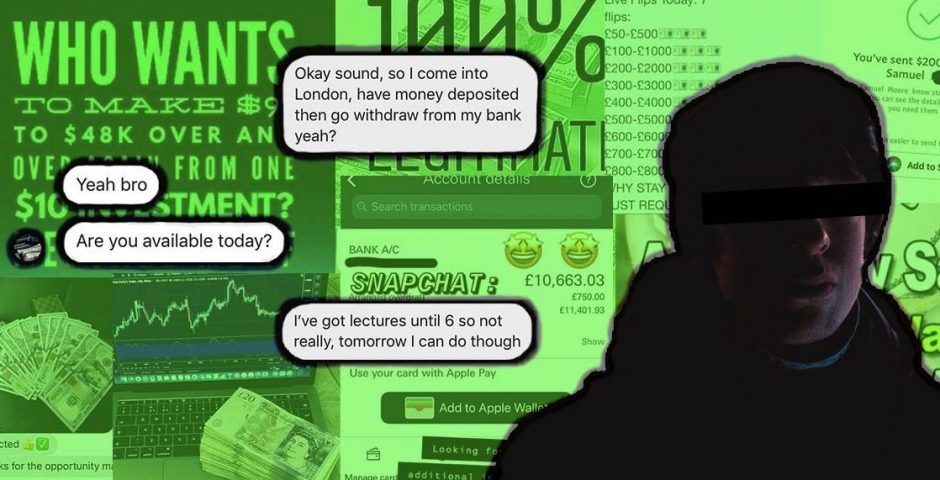

Conversations with a current fraudster over Instagram

Student Money Mules are often recruited via social media, online job ads, spam emails and even via uni sports teams. Criminals use social media to contact students with offers of instant cash and quick money schemes. At the time, the fraudsters can come across as friendly and relatable, but it’s all a front. Once you’re involved the criminals often become threatening and can pressure you to take part in more and more illegal activities.

Social media is the most common recruiting ground for student Money Mules and hashtags are frequently used to promote these illegal “get rich quick” schemes. According to Tony Sales, an ex-fraudster, these are the 10 most common hashtags used to recruit Money Mules:

#Moneyflipsuk

#Mflipssss

#Deetsandflips

#Deetsandflipping

#legitmoneyflips

#flipsanddeets

#PayPalFlip

#RealMoneyTransfers

#UkFlips

#EasyMoney

Although these may be the most used hashtags, if you type anything related to quick cash, fast money, or flips you’ll find hundreds more hashtags and Instagram accounts promising you large payoffs for very little work. Don’t fall for it. If you’re that strapped for cash, it’s much safer to just ring your parents and get some help from the bank of mum and dad. An extra £100 isn’t worth losing your bank account and getting a criminal record – or, worse.

Firstly, if it seems too good to be true, it probably is. If it was that easy to make lots of cash fast, why would so many students sell their souls and choose to become club promoters!!?! Secondly, as social media is the breeding ground for student Money Mules, be extremely wary of people DM’ing you with promises of quick money-making schemes.

However, it’s not always as obvious as getting direct messages from potential fraudsters. Don’t trust any posts which include images of piles of money or “real” bank statements trying to prove that the cash making schemes work – they don’t. Plus, any social media post or job ad that is full of spelling mistakes, poor grammar and nicknames for banks such as Natty (NatWest) are more than likely trying to recruit you for some form of illegal Money Muling activity, so ignore them too.

Then, lastly, the most obvious one – NEVER offer to lend your bank account or share your personal details with anyone.

The consequences of being a Money Mule are extreme: Losing access to a bank account for up to six years (which means you’ll have nowhere for your student loan to be sent to, no online ASOS orders, no holiday bookings, no buying club night tickets online and no Deliveroo), finding it difficult to get a job and being unable to take out a mobile phone contract.

Not only will you get a criminal record, but you could also be sentenced to prison for up to 14 years! Yes, you read that right, FOURTEEN YEARS!!! That’s nearly as long as you’ve been trapped in education.

***Don’t let yourself become another Money Muling statistic or negative student think-piece. Yes, money is great but doing something illegal to get it is not. Be wary and don’t trust anyone offering you a deal that sounds too good to be true.***

Money Muling isn’t a joke – it’s a criminal offence

Click here to learn more about how to keep your bank account safe from fraudsters